Declining balance method formula

Calculating a double declining balance is not complex although it requires some considerations. Meaning accountants first determine assets carrying amount for the period which is calculated.

Declining Balance Method Of Depreciation Examples

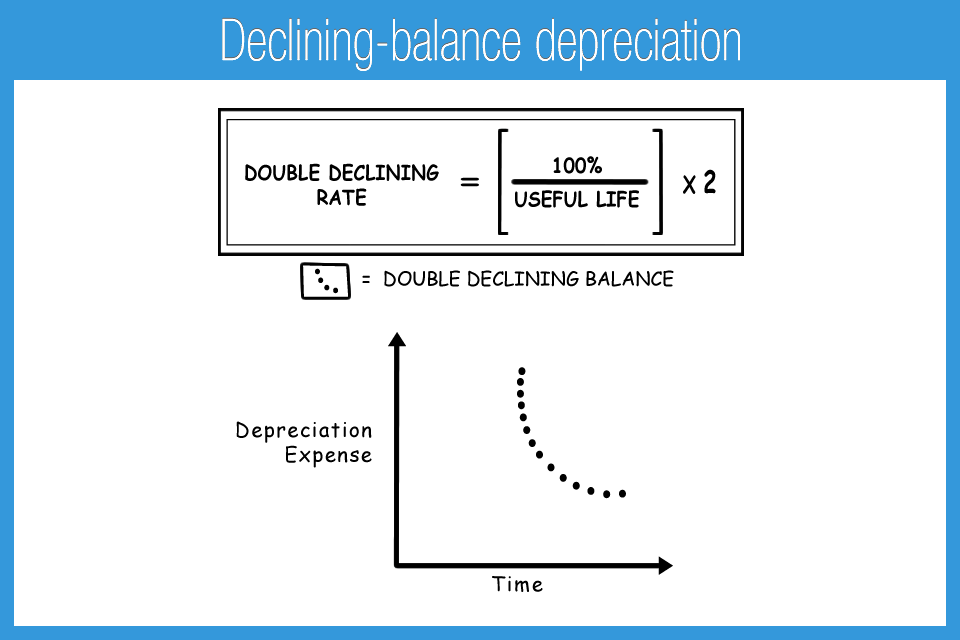

Straight line depreciation rate 1 Lifespan of the asset.

. This method depreciates an. The formula for calculating depreciation value using declining balance method is Depreciation per annum Net Book Value - Residual Value x Depreciation Rate Net Book. The declining balance formula is quite easy to use and remember if you really understand the principle of it.

This value is then multiplied by a factor declining. C B V current book value D R depreciation rate beginaligned textDeclining Balance Depreciation CBV. Formula for Double Declining Balance Method The formula for depreciation under the double-declining method is as follows.

Cost required argument This is the initial. The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset. Net Book Value Scrap Value x Depreciation Rate Calculating.

The formula for determining depreciation value using the declining balance method is- Depreciation Value. Calculate depreciation of an asset using variable declining balance method. Our formula would look like this.

In other words the depreciation rate in the. VDB cost salvage life start_period end_period factor no_switch The VDB function uses the following arguments. Declining balance method calculates the depreciation on the basis of assets net book value.

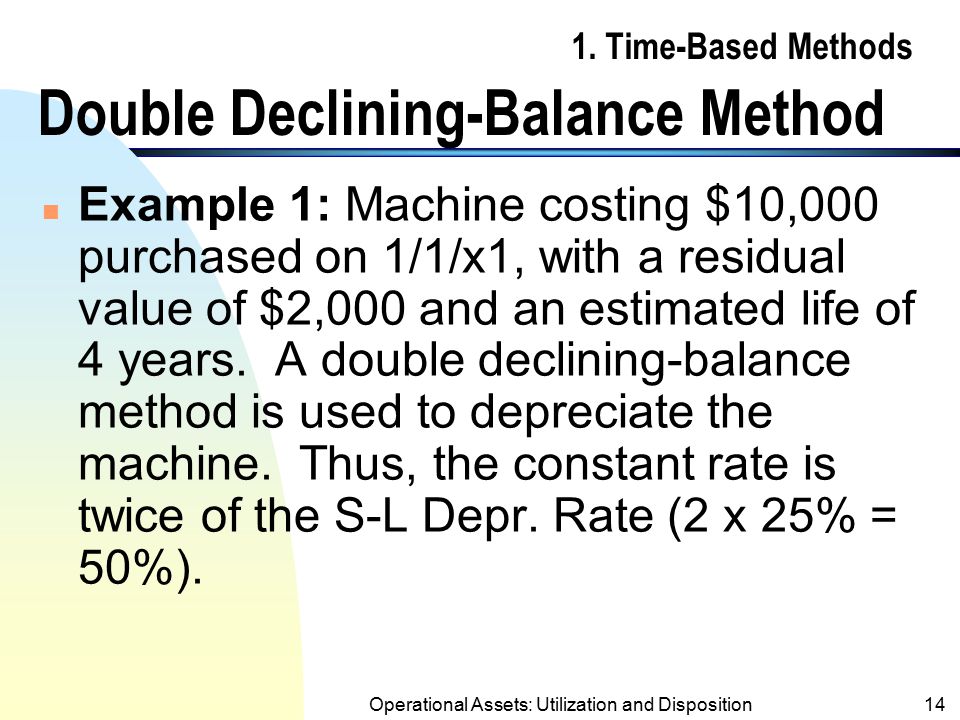

The term double in the double-declining balance depreciation comes from the determining of deprecation rate to be twice of the straight-line rate. Declining Balance Depreciation C B V D R where. The spreadsheet formula in cell A7 shows one divided by the number of years to determine the straight line percentage.

What is the formula for calculating the double-declining balance. The following is the formula Declining balance formula. Double Declining Balance Method formula 2 Book Value of.

Straight-line Depreciation Rate 1 5 02 20 Declining Balance Rate 2 20 40 Depreciation 40 20000 8000 Example 2 Referring to Example 1 calculate the. We have the formula of the double-declining balance depreciation for the fixed assets as below. To calculate the depreciation using this method we need to calculate the straight line depreciation rate first.

Depreciation 5 million 1 million 10 Depreciation 100000 The warehouse would depreciate by 110 or 10 percent each year.

Double Declining Balance Method Prepnuggets

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Method Definition India Dictionary

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Examples With Excel Template

How To Use The Excel Ddb Function Exceljet

Declining Balance Method Of Depreciation Formula Depreciation Guru

Profitable Method Declining Balance Depreciation

Simple Tutorial Double Declining Balance Method Youtube

What Is The Double Declining Balance Ddb Method Of Depreciation

Declining Balance Depreciation Calculator

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Expense Calculator Flash Sales 53 Off Www Ingeniovirtual Com

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Double Declining Balance Depreciation Daily Business